Rows: 10,000

Columns: 55

$ emp_title <chr> "global config en…

$ emp_length <dbl> 3, 10, 3, 1, 10, …

$ state <fct> NJ, HI, WI, PA, C…

$ homeownership <fct> MORTGAGE, RENT, R…

$ annual_income <dbl> 90000, 40000, 400…

$ verified_income <fct> Verified, Not Ver…

$ debt_to_income <dbl> 18.01, 5.04, 21.1…

$ annual_income_joint <dbl> NA, NA, NA, NA, 5…

$ verification_income_joint <fct> , , , , Verified,…

$ debt_to_income_joint <dbl> NA, NA, NA, NA, 3…

$ delinq_2y <int> 0, 0, 0, 0, 0, 1,…

$ months_since_last_delinq <int> 38, NA, 28, NA, N…

$ earliest_credit_line <dbl> 2001, 1996, 2006,…

$ inquiries_last_12m <int> 6, 1, 4, 0, 7, 6,…

$ total_credit_lines <int> 28, 30, 31, 4, 22…

$ open_credit_lines <int> 10, 14, 10, 4, 16…

$ total_credit_limit <int> 70795, 28800, 241…

$ total_credit_utilized <int> 38767, 4321, 1600…

$ num_collections_last_12m <int> 0, 0, 0, 0, 0, 0,…

$ num_historical_failed_to_pay <int> 0, 1, 0, 1, 0, 0,…

$ months_since_90d_late <int> 38, NA, 28, NA, N…

$ current_accounts_delinq <int> 0, 0, 0, 0, 0, 0,…

$ total_collection_amount_ever <int> 1250, 0, 432, 0, …

$ current_installment_accounts <int> 2, 0, 1, 1, 1, 0,…

$ accounts_opened_24m <int> 5, 11, 13, 1, 6, …

$ months_since_last_credit_inquiry <int> 5, 8, 7, 15, 4, 5…

$ num_satisfactory_accounts <int> 10, 14, 10, 4, 16…

$ num_accounts_120d_past_due <int> 0, 0, 0, 0, 0, 0,…

$ num_accounts_30d_past_due <int> 0, 0, 0, 0, 0, 0,…

$ num_active_debit_accounts <int> 2, 3, 3, 2, 10, 1…

$ total_debit_limit <int> 11100, 16500, 430…

$ num_total_cc_accounts <int> 14, 24, 14, 3, 20…

$ num_open_cc_accounts <int> 8, 14, 8, 3, 15, …

$ num_cc_carrying_balance <int> 6, 4, 6, 2, 13, 5…

$ num_mort_accounts <int> 1, 0, 0, 0, 0, 3,…

$ account_never_delinq_percent <dbl> 92.9, 100.0, 93.5…

$ tax_liens <int> 0, 0, 0, 1, 0, 0,…

$ public_record_bankrupt <int> 0, 1, 0, 0, 0, 0,…

$ loan_purpose <fct> moving, debt_cons…

$ application_type <fct> individual, indiv…

$ loan_amount <int> 28000, 5000, 2000…

$ term <dbl> 60, 36, 36, 36, 3…

$ interest_rate <dbl> 14.07, 12.61, 17.…

$ installment <dbl> 652.53, 167.54, 7…

$ grade <fct> C, C, D, A, C, A,…

$ sub_grade <fct> C3, C1, D1, A3, C…

$ issue_month <fct> Mar-2018, Feb-201…

$ loan_status <fct> Current, Current,…

$ initial_listing_status <fct> whole, whole, fra…

$ disbursement_method <fct> Cash, Cash, Cash,…

$ balance <dbl> 27015.86, 4651.37…

$ paid_total <dbl> 1999.330, 499.120…

$ paid_principal <dbl> 984.14, 348.63, 1…

$ paid_interest <dbl> 1015.19, 150.49, …

$ paid_late_fees <dbl> 0, 0, 0, 0, 0, 0,…Visualizing and summarizing categorical data

Data visualization and transformation

Data Science with R

Terminology

Number of variables involved

- Univariate data analysis - distribution of single variable

- Bivariate data analysis - relationship between two variables

- Multivariate data analysis - relationship between many variables at once, usually focusing on the relationship between two while conditioning for others

Types of variables

- Numerical variables can be classified as continuous or discrete based on whether or not the variable can take on an infinite number of values or only non-negative whole numbers, respectively.

- If the variable is categorical, we can determine if it is ordinal based on whether or not the levels have a natural ordering.

Data

Data: Lending Club

- Thousands of loans made through the Lending Club, which is a platform that allows individuals to lend to other individuals

Not all loans are created equal – ease of getting a loan depends on (apparent) ability to pay back the loan

Data includes loans made, these are not loan applications

Take a peek at data

Selected variables

loans <- loans_full_schema |>

select(

loan_amount, interest_rate, term, grade,

state, annual_income, homeownership, debt_to_income

)

glimpse(loans)Rows: 10,000

Columns: 8

$ loan_amount <int> 28000, 5000, 2000, 21600, 23000, 50…

$ interest_rate <dbl> 14.07, 12.61, 17.09, 6.72, 14.07, 6…

$ term <dbl> 60, 36, 36, 36, 36, 36, 60, 60, 36,…

$ grade <fct> C, C, D, A, C, A, C, B, C, A, C, B,…

$ state <fct> NJ, HI, WI, PA, CA, KY, MI, AZ, NV,…

$ annual_income <dbl> 90000, 40000, 40000, 30000, 35000, …

$ homeownership <fct> MORTGAGE, RENT, RENT, RENT, RENT, O…

$ debt_to_income <dbl> 18.01, 5.04, 21.15, 10.16, 57.96, 6…Selected variables

| variable | description |

|---|---|

loan_amount |

Amount of the loan received, in US dollars |

interest_rate |

Interest rate on the loan, in an annual percentage |

term |

The length of the loan, which is always set as a whole number of months |

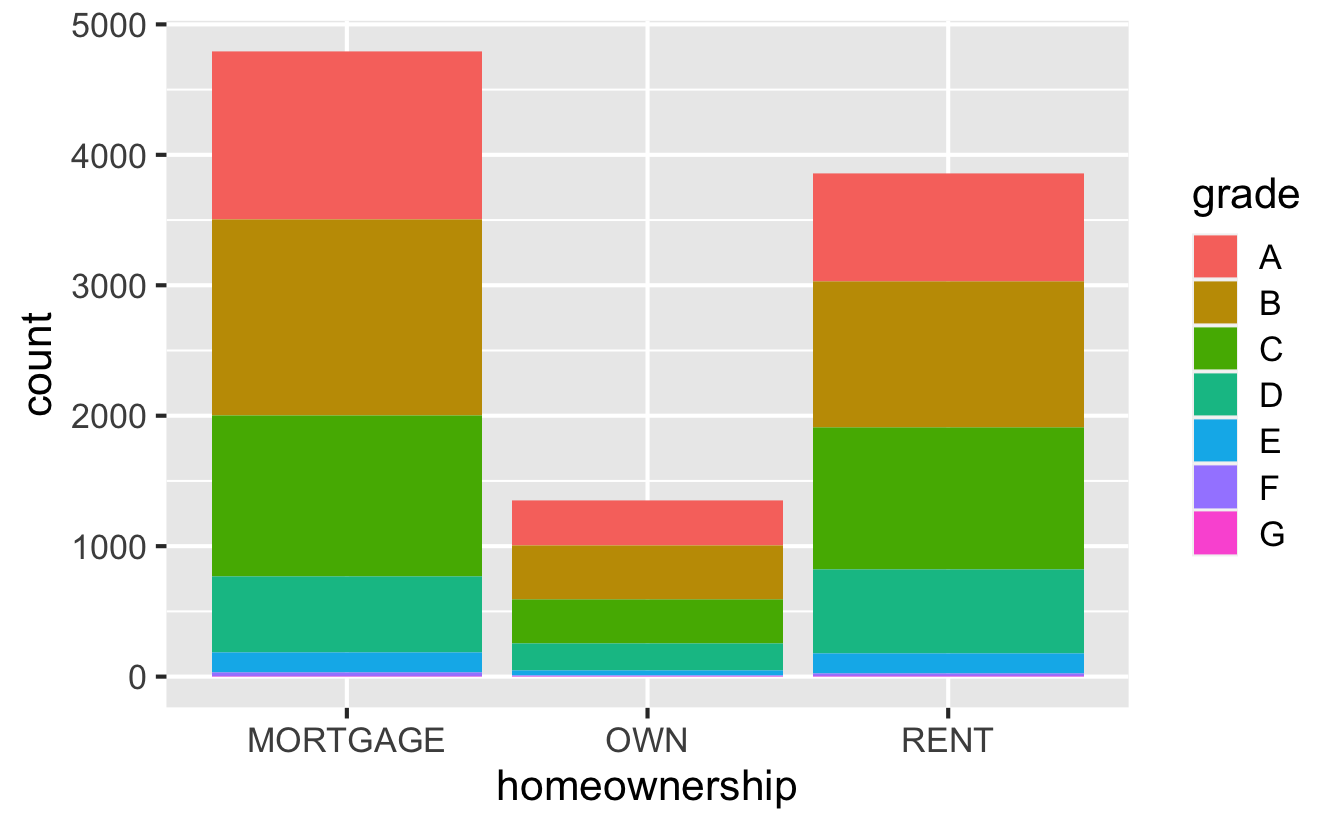

grade |

Loan grade, which takes a values A through G and represents the quality of the loan and its likelihood of being repaid |

state |

US state where the borrower resides |

annual_income |

Borrower’s annual income, including any second income, in US dollars |

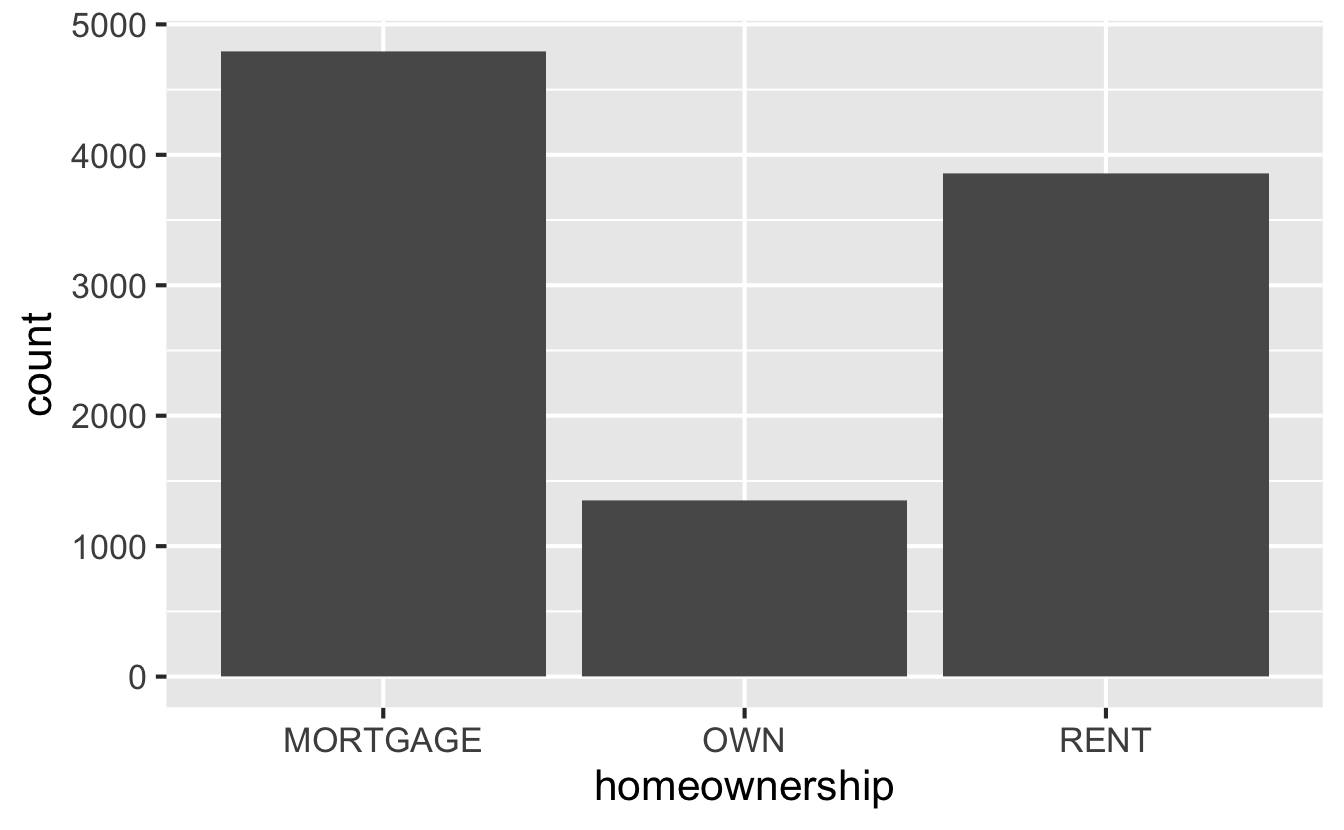

homeownership |

Indicates whether the person owns, owns but has a mortgage, or rents |

debt_to_income |

Debt-to-income ratio |

Variable types

| variable | type |

|---|---|

loan_amount |

numerical, continuous |

interest_rate |

numerical, continuous |

term |

numerical, discrete |

grade |

categorical, ordinal |

state |

categorical, not ordinal |

annual_income |

numerical, continuous |

homeownership |

categorical, not ordinal |

debt_to_income |

numerical, continuous |

Visualizing categorical data

Bar plot

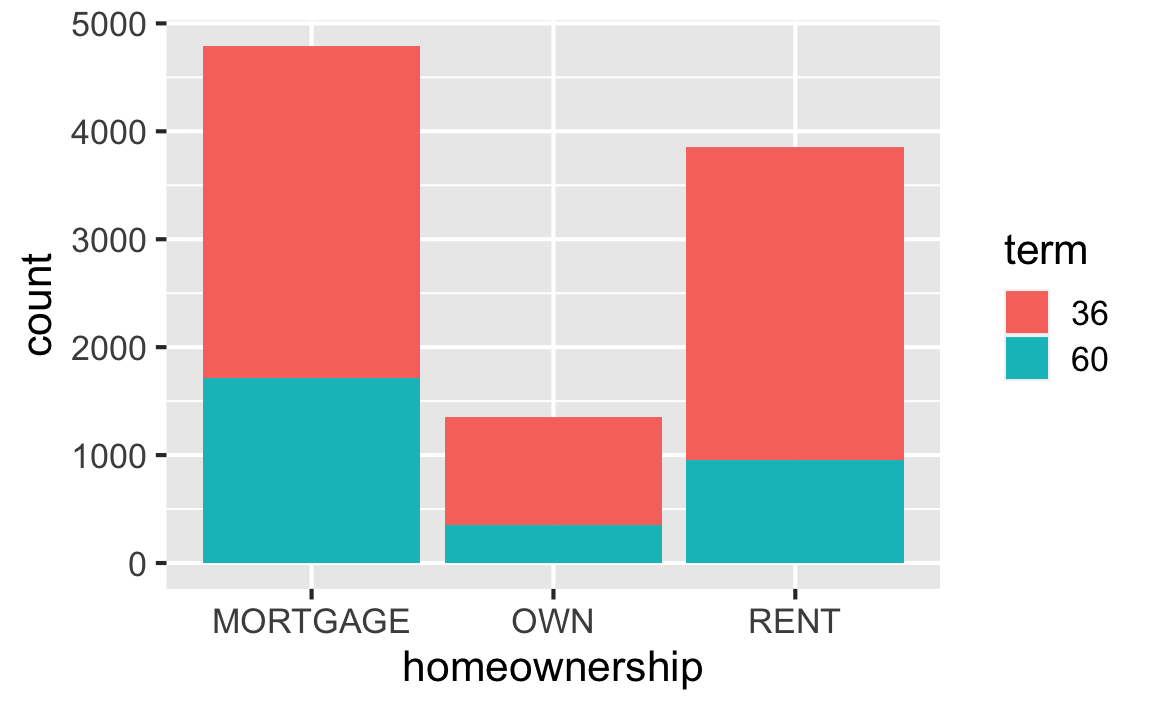

Segmented bar plot

Segmented bar plot

Warning: The following aesthetics were dropped during statistical

transformation: fill

ℹ This can happen when ggplot fails to infer the correct

grouping structure in the data.

ℹ Did you forget to specify a `group` aesthetic or to

convert a numerical variable into a factor?

Numerical to categorical

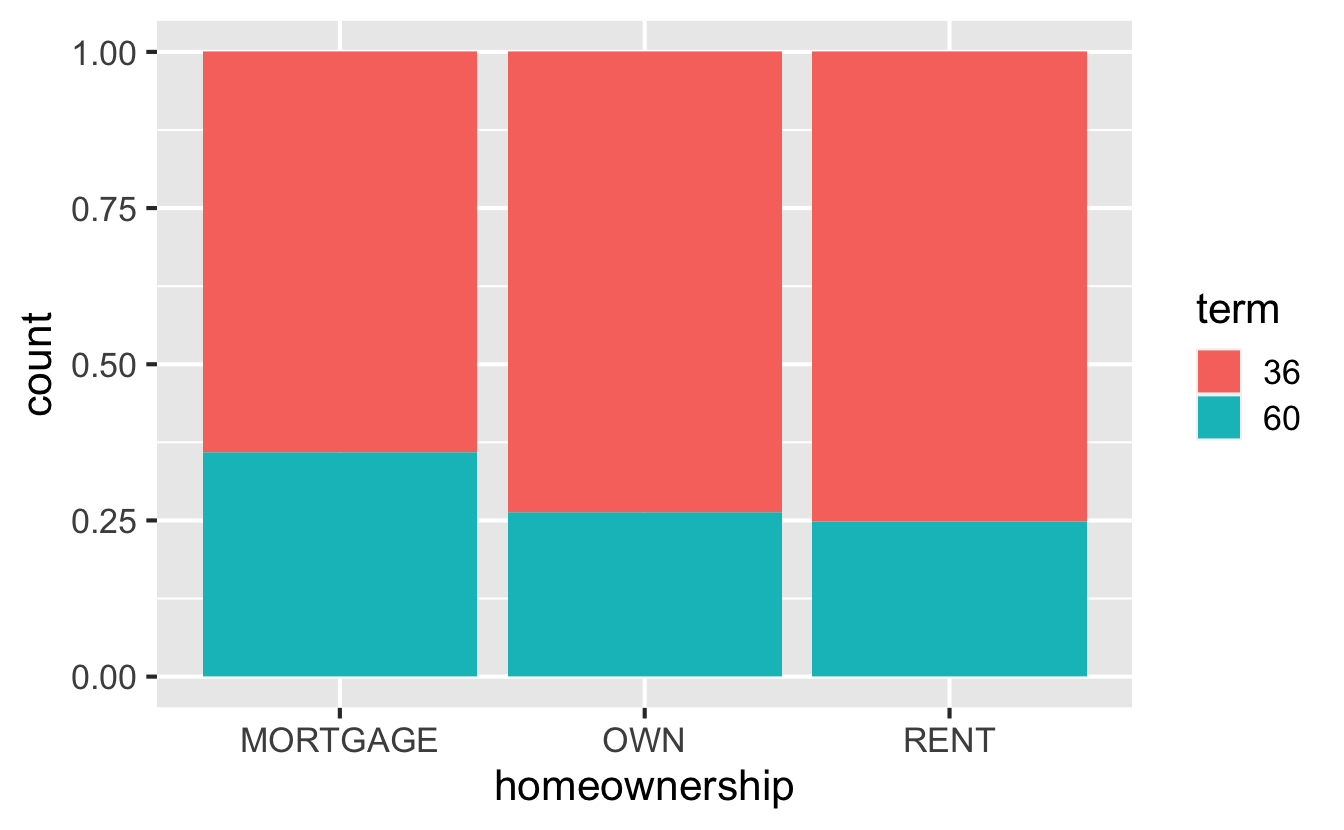

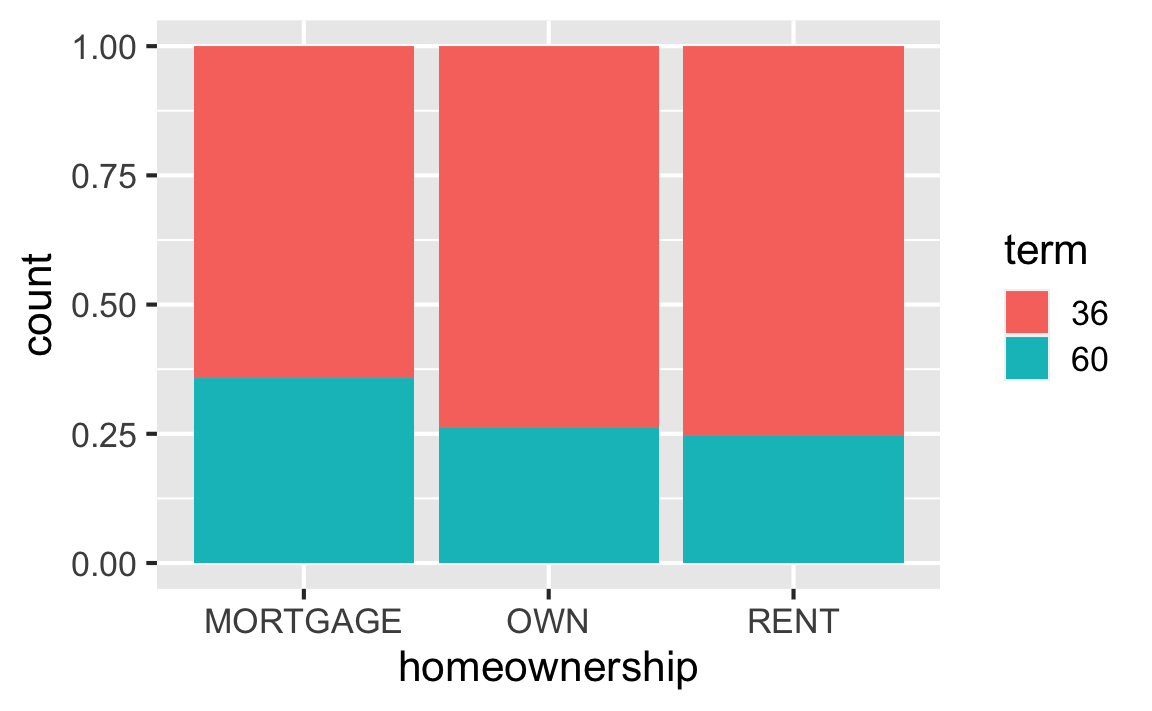

Segmented bar plot - proportions

Frequencies vs. proportions

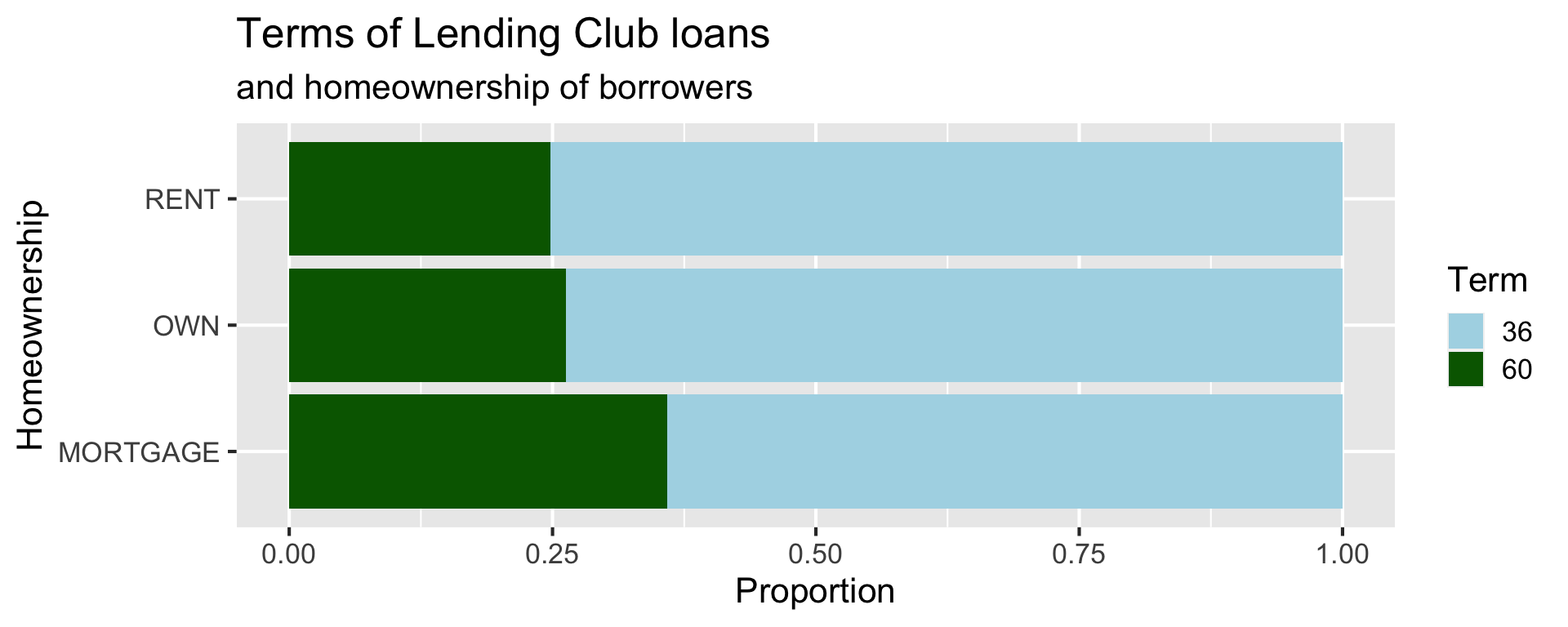

Which bar plot is a more useful representation for visualizing the relationship between homeownership and term?

Customizing bar plots

loans |>

mutate(term = as.factor(term)) |>

ggplot(aes(y = homeownership, fill = term)) +

geom_bar(position = "fill") +

labs(

x = "Proportion", y = "Homeownership", fill = "Term",

title = "Terms of Lending Club loans",

subtitle = "and homeownership of borrowers"

) +

scale_fill_manual(values = c("lightblue", "darkgreen"))

Summarizing categorical data

Frequency table

Relative frequency table

Frequency table with multiple variables

Relative frequency table with multiple variables

# A tibble: 6 × 4

# Groups: homeownership [3]

homeownership term n proportion

<fct> <dbl> <int> <dbl>

1 MORTGAGE 36 3071 0.641

2 MORTGAGE 60 1718 0.359

3 OWN 36 998 0.738

4 OWN 60 355 0.262

5 RENT 36 2901 0.752

6 RENT 60 957 0.248